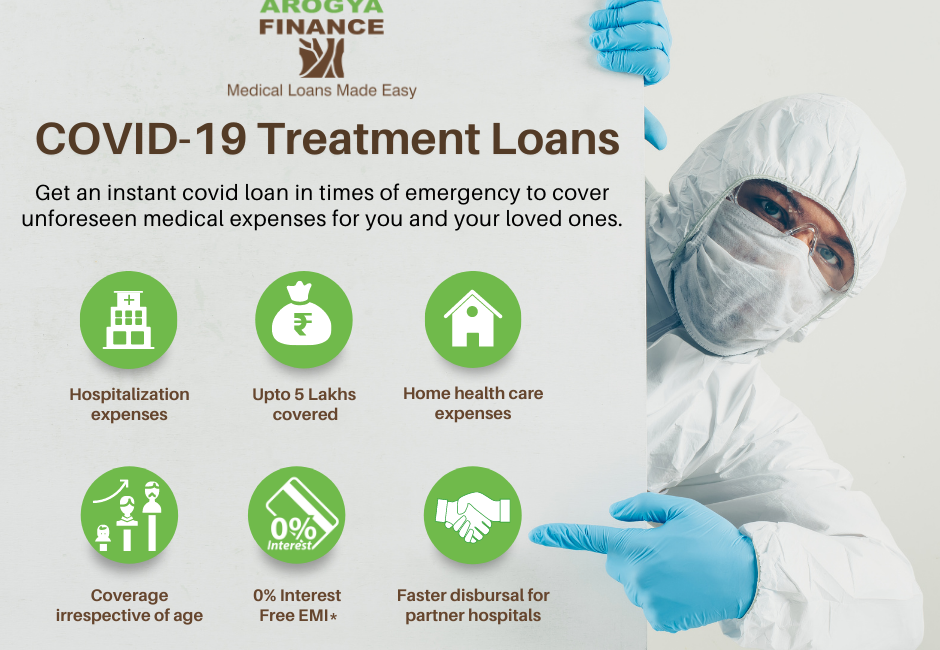

Covid-19 Treatment Loans from Arogya Finance

India witnessed a huge increase in covid positive patients in the second wave and health care has been the top priority and the need of the hour. As the number of serious Covid-19 cases in India continues to rise, the government has increased the health care facilities nationwide but innumerable families have been financially impacted by the high treatment costs at most private hospitals. Many citizens are concerned about how will they manage funds for the treatment. It is important to be prepared for any adverse situations ahead of time. Not only is the pandemic a health emergency, but it is also an economically difficult time.

At Arogya Finance we are conscious of the medical needs that you and your family members may have during these challenging times.

Arogya Finance is a social health care venture, which offers medical loans to the traditionally

un-bankable, using innovative risk assessment tools that allows them to finance people outside the formal banking system. Patients borrow from and repay Arogya Finance directly leaving them free to get treated wherever they choose to do so.

We have a medical loan for your family for COVID-19 related Hospitalization / Homecare along with our existing Medical Loans for other treatments.

Instant Medical Loan for COVID-19 Treatment

– Get instant loan sanction based on the online application;

– Loans for both treatment at hospitals as well as homecare;

– Hospital expenses of up to 5 Lakhs covered based on borrower’s eligibility;

– Faster disbursal for partner hospitals, ask for Arogya Finance or call us.

With an aim to ease the financial burden of medical treatment, Arogya Finance, a social healthcare venture, has launched Arogya Card with the facility of a pre-approved loan of up to Rs.5 lakh. Anyone with a net monthly income of or above Rs.15000 can avail the facility

“Unexpected healthcare shocks are leading over 40 million Indians to poverty every year, Arogya Finance has taken a step to bridge this gap by launching the Arogya Card that offers pre-approved loans at reasonable terms by making it available at the right time and place of need to those who lack collateral or formal income proof,” said Jose Peter, Co-Founder and CEO of Arogya Finance. He describes the facility as a one-stop financial solution for people in need whenever and wherever there is an unforeseen medical emergency.

The Arogya Card does not require collaterals or formal income proof which is mandatory in other forms of financial assistance. Arogya Finance offers a pre-approved loan and makes it easily available within 24 hours.

The card offers medical loans to the traditionally un-bankable, using psychometric tests as an innovative risk assessment tool, which enables evaluation of the credit risk profile of people outside the formal banking system.

The borrowers can repay the loans in easy monthly instalments of up to 36 months.

For more details visit us at www.arogyafinance.com and reach out to our regional Financial Counsellors. In case of any queries call us at +91 9769205032 / 9769286254″. (*) T & C apply