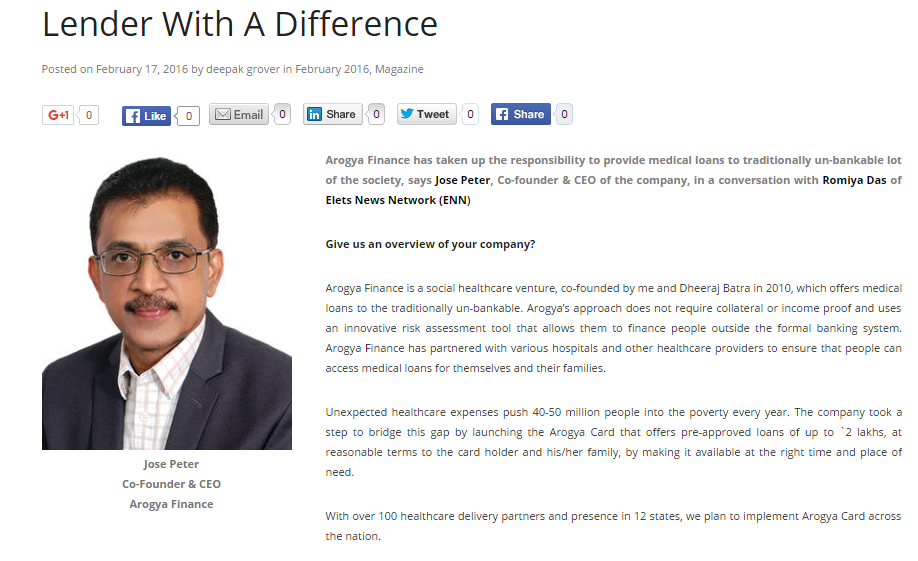

Arogya Finance has taken up the responsibility to provide medical loans to traditionally un-bankable lot of the society, says Jose Peter, Co-founder & CEO of the company, in a conversation with Romiya Das of Elets News Network (ENN)

Give us an overview of your company?

Arogya Finance is a social healthcare venture, co-founded by me and Dheeraj Batra in 2010, which offers medical loans to the traditionally un-bankable. Arogya’s approach does not require collateral or income proof and uses an innovative risk assessment tool that allows them to finance people outside the formal banking system. Arogya Finance has partnered with various hospitals and other healthcare providers to ensure that people can access medical loans for themselves and their families.

Unexpected healthcare expenses push 40-50 million people into the poverty every year. The company took a step to bridge this gap by launching the Arogya Card that offers pre-approved loans of up to `2 lakhs, at reasonable terms to the card holder and his/her family, by making it available at the right time and place of need.

With over 100 healthcare delivery partners and presence in 12 states, we plan to implement Arogya Card across the nation.

What is your opinion on the escalating healthcare startup market in the country?

There are multiple challenges in improving the quality of healthcare of Indians. It will take decades to make a significant impact with traditional approaches. This requires nothing less than game-changing breakthroughs to accelerate gains. Innovation is the key and start-ups are at the cutting edge of innovation.

India is home to 1.2 billion people with a US$ 2 trillion economy and a US$ 100 billion healthcare industry. However, only 17 per cent of Indians have some form of health insurance. 95 per cent of even those who are insured is under insured to the extent of 60 per cent. Of the healthcare spend of five per cent of GDP, public spend is only one per cent of the GDP, leaving 75 per cent of the healthcare expenses to be spent out of pocket by private individuals.

Innovative healthcare delivery start-ups are deep diving into this huge opportunity to make healthcare cheaper and to bring it closer to the patient. The healthcare delivery sector is very nascent and will grow rapidly for several more years. The future is very bright. Creating healthcare affordability through Financial Inclusion is another area. On the last count, there are more than 22 online lending platforms slowly taking off and many of them are looking at creating EMI options to meet healthcare expenses. Given the right environment and incentives, these initiatives have the potential to push healthcare spend to beyond the six per cent of GDP mark, leading to the creation of millions of jobs and billions of dollars for the healthcare start- ups and the Investors.

What is the criterion for selecting a start-up to fund?

Major challenges in healthcare in India are awareness, availability and affordability. If the start-ups are focusing on one of these challenges and have scalability, without huge additional investments, it is a venture to invest in.

Is funding requirement in this sector high?

Healthcare industry has been expected to be US$100 billion in 2015 and is widely expected to be US$280 billion by 2020. In such a scenario, there is a definite need for huge investments, which may run into billions of dollars yearly.

How long is your stay with the company?

In reality, it is three to five years at least. The venture capitalists exist generally happens either with another investor stepping in and taking over or someone strategically acquiring. The IPO option has not been too many, but it has slowly started opening up and may be going forward it might become an option.

What is your company’s upcoming business plan?

We currently have our operations in 10 states – West Bengal, Maharashtra, Karnataka, Hyderabad (Telangana), Tamil Nadu, Kerala, NCR, Jharkhand, Bihar, Gujarat. We look forward focusing on our services in the years to come. Accordingly, Arogya Finance will issue 18 lakh Arogya Cards and 2.35 lakh healthcare loans in the next five years and is working to be a 1,000-crore company by FY20 and expand to pan India operations.