Arogya Finance is a social health care venture, which offers medical loans to all including the traditionally un-bankable, using innovative risk assessment tools that allows them to finance people even outside the formal banking system. Being a FinTech and a registered NBFC, Patients borrow from and repay Arogya Finance directly leaving them free to get treated wherever they choose to do so.

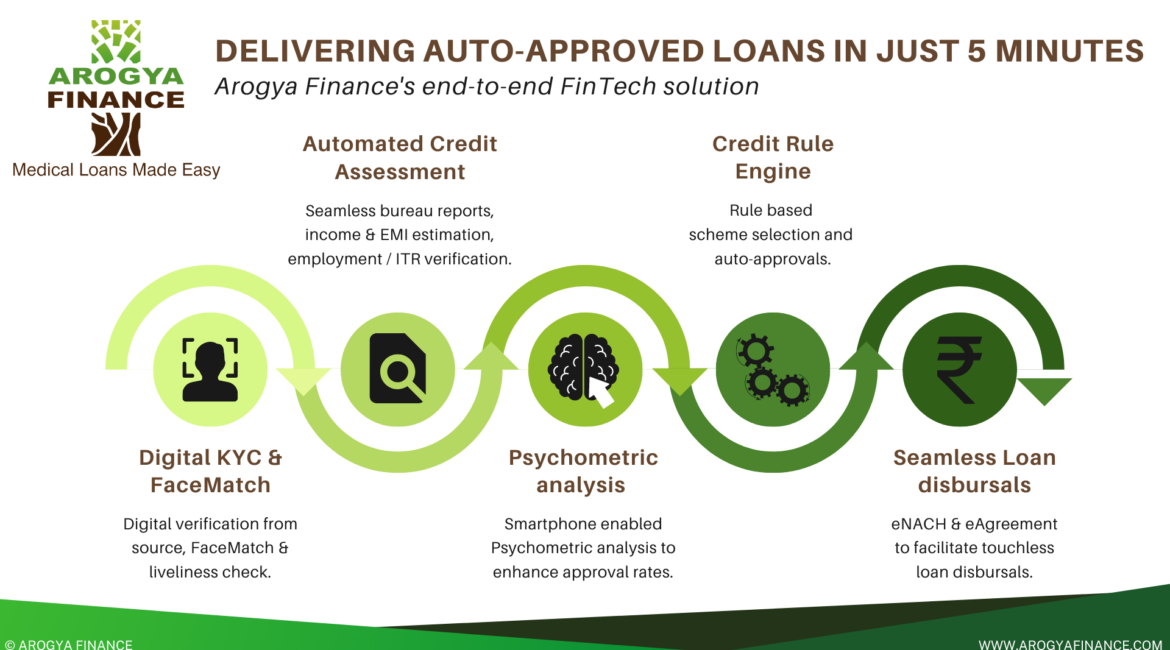

In the recent years, FinTechs have disrupted the financial industry, backed by Banks or NBFCs and providing the best of technology and ease of access to the consumers for faster access to funds. Arogya Finance is a winning combination of both being an NBFC and a FinTech with a system which offers loan approvals to patients in a matter of minutes and with attractive schemes like the 0% Interest-free EMI’s* The system developed is measurable, accurate, fast, flexible and dynamic, our software is highly customized and has been integrated with many systems which streamline the lending process. Our end to end FinTech solution has led to an increase in efficiency and effectiveness which has resulted in auto approvals, quick disbursals and thus, an increase in customer delight.

Let us understand this in more detail:

Online Application –

Any of our borrowers can login and register for a loan via our website or mobile app. The verification process is easily completed online with identification and authentication via source of KYC digitally and FaceMatch & Liveliness to minimize any chance of fraud.

Automatic Credit Assessment –

The borrowers credit score is analysed automatically using our fully automated Credit Bureau integration. The credit assessment step is seamless with bureau reports, Income & EMI estimation or ITR verification as required, all within a matter of seconds.

Psychometric Test – Our Psychometric analysis helps gauge the potential borrower’s psyche on various parameters and increase the approval rates, used in cases of the new to credit (NTC) and low credit score audience. This test is readily available on any smartphone or computer devices across operating systems, just as our application and is triggered by our self-designed Credit Rule Engine

Credit Rule Engine – Our inhouse designed Credit Rule Engine or CRE is the backbone of the application’s decision-making capabilities, this CRE gets all data from our application and various third party APIs, using this data, the algorithm decides the best offer or scheme available to fund the cost of treatment instantaneously, this helps the borrower choose from an array of options of schemes available to decide the best suited scheme of repayment including the flexibility in choice of EMI amount, tenure and rate of interest. All of which is auto approved for immediate sanction. The end of this activity which takes mere seconds to perform, allows the borrowers with strong profiles to receive the sanction letter for the loan via email. We notify our partners of the same and send a copy of this sanction letter to ease the burden of communication for the borrower in need.

Seamless Loan Disbursal – Once sanctioned the borrower pays advance EMIs, completes eNACH and an OTP signed eAgreement. This facilitates seamless disbursals and enables the borrower to repay the EMIs from the linked bank account monthly for the tenure agreed upon in a hassle free method, without the need of cheques or visiting any bank to deposit the EMI. Upon opting for these, the borrower enables us to disburse the funds seamlessly to the partner hospital or clinic within no time.

The above process displays an effective method of how a traditional NBFC like ours has achieved the FinTech method to auto approve loans within 5 minutes or less. Achieving this has enabled us to reach our borrowers via our website and various hospitals and lend to them at the best available interest rates for their or their near and dear one’s treatment. So when in need of any emergency funds in minutes for medical purposes, reach out to us at arogyafinance.com and fill out the application to get your loan approved in minutes, this way, we take away your worry of the cost of treatment, while you spend your valuable time with your family and friends.